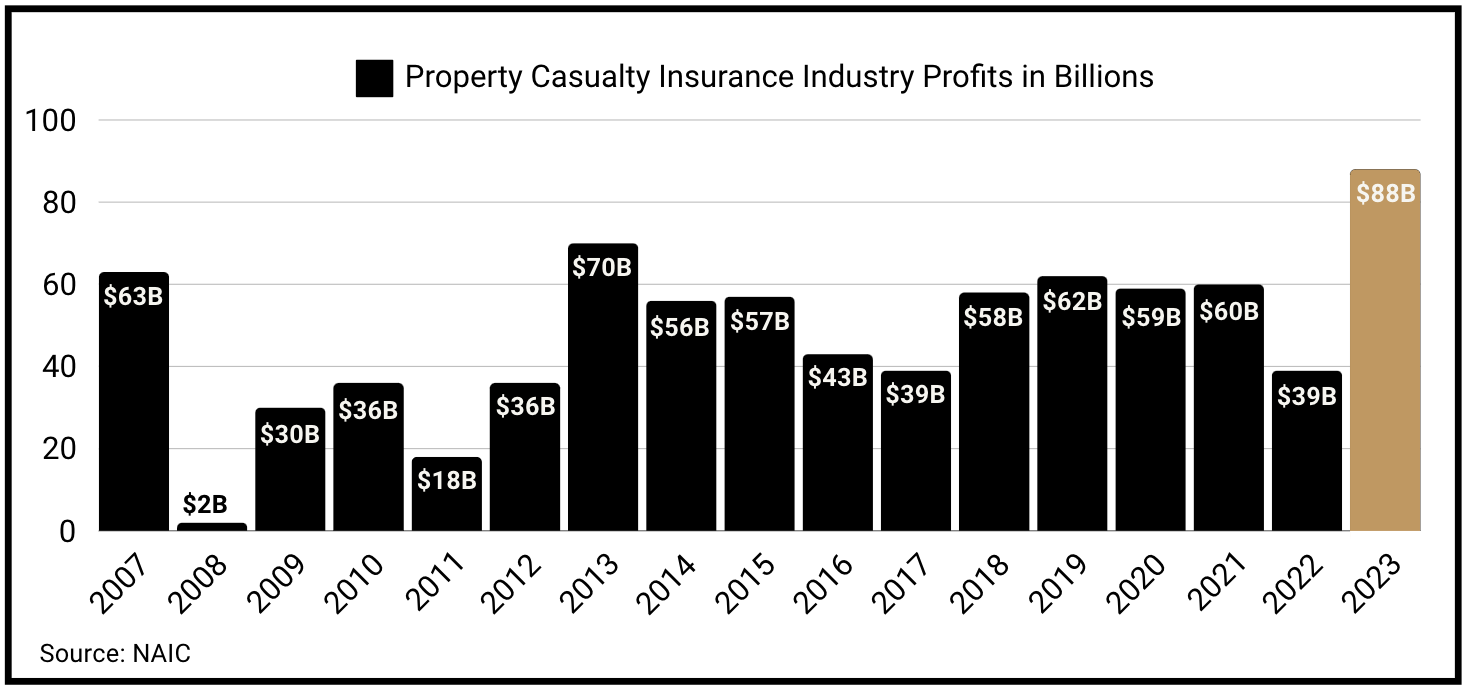

Iowans rely on their home insurance policies to recover from an increasing number of severe weather events, including an unprecedented derecho, town-flattening tornadoes, and surging flood waters. But just when storm-ravaged Iowans need insurance protection the most, many insurance companies are jacking up rates by 50% or more or dropping homeowner’s coverage altogether. “Instead of doing what they are supposed to do, which is serve their customers, they are cutting loose by the droves,” said Eldon Neighbor, an independent insurance agent from eastern Iowa, in an extensive report on a disturbing nationwide trend. Too bad, say executives from the major property and casualty insurance companies. Iowa has joined a growing number of states outside of traditionally storm-prone coastal states to experience frequent catastrophic weather events. While gritting their teeth and wringing their hands, they are telling devastated Iowa families they have no choice but to drastically increase rates or curtail coverage as losses from claims pile up. Here’s the catch: The insurance industry is seeing record profits!  While some companies might be seeing temporary homeowners insurance losses in a couple states, they are earning record-breaking profits from policies in other states, other lines of business, and investments. According to the National Association of Insurance Commissioners, the property casualty insurance industry—which covers losses due to property damage, personal injury, and financial loss—earned $88 billion in profits in 2023—its most profitable year of all time—even as insurance executives claim the sky is falling. And despite more bad weather in Iowa and other parts of the country this year, AM Best reports that profitability continues to surge for property casualty insurers in 2024, with first-quarter income reaching $40 billion. If earnings continue at that pace, the industry will shatter the 2023 record profits. Example in point: Nationwide, headquartered in Des Moines, recently announced record profits in 2023 while halting or making it “near-impossible to place a new homeowners policy,” according to one insurance broker. So, which is it: a financial crisis and excuses to Iowa homeowners or record profits and what looks to us like a cynical business decision designed to boost profits even further? Let’s be clear. We want the insurance industry to be profitable. We all depend on insurance to recover from the unexpected, whether it involves our homes, vehicles, or health. Insurance also plays a critical role in underpinning a national economy that depends on property. Over the coming weeks, we will dive deeper into this topic and try to separate what the insurance industry tells Wall Street about booming business while telling Americans a very different story. Because as we said, we all need insurance, but we also deserve the truth. |